Generative AI, commonly known as GANs (Generative Adversarial Networks), has gained significant attention and found applications in various fields, including the financial services sector. This technology leverages artificial intelligence techniques to generate new data that closely resembles the training datasets. It consists of generators that create samples and discriminators that evaluate the generator's performance against real data samples, thereby improving its capabilities.

The market size of Generative AI in Financial Services is projected to reach USD 9,475.2 million by 2033, showing substantial growth from its current value of USD 847.2 million in 2022. This growth is anticipated to be driven by a high compound annual growth rate (CAGR) of 28.1% between 2023 and 2033. In this article, we will delve into the diverse use cases of AI in the finance industry, highlighting the benefits it brings and discussing future outlook that pertain to AI in the financial services sector.

Generative AI in Financial Services

In a time when brick-and-mortar businesses are facing difficulties sustaining customer relationships and achieving growth, generative AI presents a digitally driven approach that can significantly enhance customer engagement and drive positive business results. By harnessing the extensive pool of data accessible in the financial services sector, generative AI empowers firms to deliver personalized experiences to their customers, improve risk management practices, and streamline operational efficiency. With the power to generate new ideas and drive innovation, generative AI in finance can assist in navigating the current market's challenges and emerging more substantial on the other side.

Generative AI has emerged as a prominent catalyst within the financial services sector, demonstrating a multitude of successful implementations and continuously evolving applications. These innovative solutions, powered by AI, have revolutionized the operational landscape of financial institutions, facilitating improved customer experiences, operational efficiency, and cost reduction. With a constant influx of new examples, generative AI continues to reshape the industry and its possibilities.

How Can Generative AI Be Used in Financial Services?

- Credit Decision-Making:

Generative AI models can assess massive volumes of financial data, such as credit scores, transaction histories, and spending patterns while taking macroeconomic trends and regional demographic information into account. These AI in financial services models can create accurate credit risk assessments and forecast future borrower behaviour by simulating numerous situations, enhancing the quality of lending decisions, and reducing default risks. - Fraud Detection and Prevention:

By recognizing small deviations from typical behaviour patterns, the complex algorithms created by generative AI may not only identify patterns of fraudulent actions but also foresee new dangers. These algorithms continuously learn from and update themselves based on the most recent data, ensuring that financial firms stay one step ahead of fraudsters and have a solid defence against financial crimes. - Investment Management:

Generative AI models can assess a wide range of data sources, including news articles, social media sentiment, and economic indicators, to generate insights into trends in the market and potential investment possibilities. These AI-powered predictions can assist investors in identifying inexpensive assets or predicting market moves, improving portfolio performance and reducing risks. - Robotic Process Automation (RPA):

Using RPA, AI in financial services may assess workflows and find inefficiencies inside financial institutions, recommend ideal process improvements, and develop algorithms to automate these tasks. By doing so, the organization's activities are streamlined, costs are reduced, and overall productivity is increased. - Personalized Banking:

Generative AI may develop personalized financial suggestions, such as customized investment strategies or savings plans, by assessing consumer data and preferences. This allows financial firms to provide customized financial solutions, which can lead to higher client satisfaction and retention rates. - Claims Management:

To create reliable damage estimates, generative AI can examine multiple data sources, such as text descriptions, photos, and videos of damaged items. Insurance companies can reduce the time and resources required to settle claims by automating this process, resulting in faster payouts and happy clients. - Dynamic Pricing:

Generative AI can examine a wide range of variables, including customer behaviour, rival pricing, and market conditions, and generate optimal pricing models for insurance products. Insurers may offer competitive and personalized pricing by regularly upgrading these models, ensuring they remain appealing to potential clients while retaining profitability. - Regulatory Compliance:

Generative AI can examine complicated rules, such as know-your-customer (KYC) and anti-money laundering (AML) standards, and provide useful insights on how to fulfil these duties. Generative AI finance may lower the chance of human error and make sure they stay compliant by automating the compliance process. This will help them avoid exorbitant fines and reputational harm. - Customer segmentation:

Using data about customers and trends such as spending patterns, risk tolerance, and financial objectives, generative AI may categorise customers into specific groups. Financial institutions can create focused marketing efforts, provide appropriate product offerings, and offer individualized customer service by developing a deeper understanding of their consumers. This can increase customer loyalty and income.

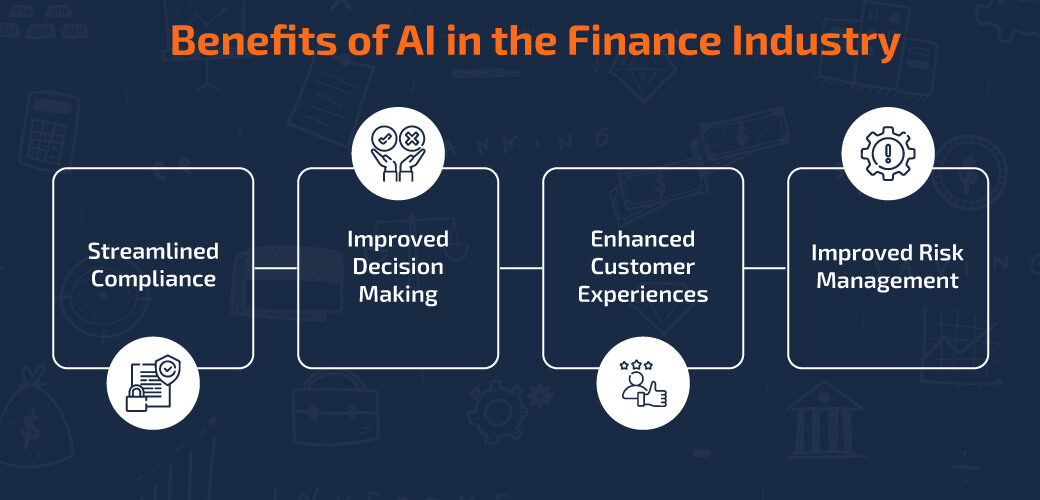

Benefits of AI in the Finance Industry

AI is transforming the financial services business by bringing several benefits that assist financial firms in improving their operations, improving customer experiences, and increasing profitability. Here are some of the primary benefits of artificial intelligence in financial services industry:

- Improved decision-making:

AI systems can analyse massive volumes of data in real-time, offering insights that impact investment strategies, credit risk assessments, and lending decisions. Financial firms may lower the risk of default, identify new possibilities, and enhance profitability by utilising AI to make better decisions. - Enhanced efficiency:

By automating laborious tasks such as compliance monitoring, loan underwriting, and fraud detection, AI enables significant time and cost savings. This streamlined approach eliminates the need for manual processes, boosts overall efficiency, and allows businesses to allocate resources towards more impactful initiatives. - Increased security:

Through real-time transaction monitoring and detection of suspicious activities, AI algorithms enhance the security of financial services businesses. By promptly identifying potential fraud and flagging questionable transactions, these technologies play a crucial role in protecting the assets of financial firms, reducing the risk of fraudulent actions, and bolstering overall security. - Better risk management:

AI algorithms may assess information from a variety of sources, including consumer behaviour, market trends, and economic indicators, to spot potential risks and take preventative action to reduce them. This improves risk management, lowers the chance of default, and safeguards the assets of financial firms. - Streamlined compliance:

Generative AI facilitates streamlined compliance within the financial services industry through the automation of compliance monitoring and risk management tasks. This automation effectively decreases the time and expenses typically associated with manual compliance processes. As a result, AI in financial services can ensure regulatory compliance, diminish the likelihood of regulatory fines and penalties, and elevate their overall compliance endeavours.

How Generative AI is impacting the Finance Sector

- Fraud detection and prevention:

Financial firms are leveraging generative AI algorithms to detect and prevent fraudulent activities. These algorithms can analyze vast amounts of data, identify patterns, and flag suspicious transactions or behaviours in real-time. By continuously learning from new data, generative AI systems can improve their fraud detection capabilities over time. - Risk assessment and management:

Generative AI models can assist financial firms in assessing and managing risks more effectively. By analyzing historical data and market trends, these models can generate simulations and scenarios that help quantify and predict potential risks. This enables financial organizations to make more informed decisions regarding investments, lending practices, and portfolio management. - Algorithmic trading and investment strategies:

Generative AI is also revolutionizing algorithmic trading and investment strategies. By analyzing vast amounts of financial data and market trends, AI models can generate predictive insights and automate trading decisions. These models can quickly identify patterns and anomalies, execute trades at high speeds, and adapt to changing market conditions in real-time. - Natural language processing and customer service:

Generative AI-powered chatbots and virtual assistants are transforming customer service in the financial sector. These AI systems can understand and respond to customer inquiries and requests in natural language, providing quick and accurate information. They can handle routine tasks such as balance inquiries, transaction history, and account management, freeing up human agents to focus on more complex customer needs. - Credit scoring and underwriting:

Generative AI in financial services is improving the accuracy and efficiency of credit scoring and underwriting processes. By analyzing a wide range of data points, including credit history, financial statements, and behavioural patterns, AI models can generate more accurate risk assessments. This enables financial firms to make faster and more informed decisions when it comes to approving loans, mortgages, or credit applications.

These advancements are enabling financial firms to operate more efficiently, make better-informed decisions, and deliver enhanced value to their customers.

Future Outlook of AI in the Financial Sector

The future of AI in the financial services industry is filled with promise and potential, reshaping the way businesses operate. With the rapid advancements in AI technology and the growing availability of data, financial firms have a unique opportunity to leverage AI's capabilities for growth.

The convergence of AI and blockchain is just the beginning; as these technologies continue to evolve, we can expect further advancements and applications that go beyond the traditional boundaries of finance.

At Sparkout, we pride ourselves on being at the forefront of leveraging the power of generative AI to drive innovation and efficiency. We understand the changing landscape and are committed to helping our clients navigate the future of financial services through cutting-edge AI solutions.

To discover how we can assist you in preparing for the future of financial services with generative AI, reach out to us today.

Translate

Translate

Author Bio

Sivabharathy

Lead Project Manager

Sivabharathy is a technical architect, technology enthusiast, and voracious reader. His visionary perspective has earned him opportunities to work with innovative projects in the computer software industry. He is an expert in PHP, JavaScript, NodeJS, Angular, Ethereum, Web3, Product Development, and Teamwork.