The moment a customer hits the “Pay Now” button on your website, the next few seconds will determine whether to make or break the purchase. This is where the payment gateway integration in website makes its appearance. It ensures that every transaction has been carried out smoothly and securely without any hiccups across devices and payment methods.

Besides completing the payments efficiently, a properly integrated ecommerce website payment system also creates trust, minimizes checkout friction, and supports business growth. With this integration, websites can have multiple payment options while keeping the customer’s sensitive data safe and secure. This creates a seamless experience and makes the customers proceed with more payments.

This blog gives a deeper insight into payment gateway integration in website, exploring its different types and the algorithm to set it up seamlessly on your website.

What is Payment Gateway Integration?

Payment gateway integration is a structured process of connecting a website or application with a secure online payment system to smoothen the online transactions. This acts as a bridge between the customer’s payment method, including credit cards or digital wallets, making sure the funds are transferred safely and efficiently.

Beyond generic payments, a well-executed integration handles authentication, encryption, and real-time transactions, which makes the online transfers seamless for users, maintaining compliance with financial regulations. At its core, it transforms web and mobile app development and transaction workflows into a secure platform, which is capable of accepting and managing digital payments with confidence.

How Does Payment Gateway Integration in Website Actually Work?

The working of the payment gateway integration in website begins when a customer submits the payment details on any website’s checkout page. After this, it captures the sensitive information securely, encrypts the data and transmits it to the payment processor. This step makes sure that sensitive payment info is protected while the transaction request moves through the payment network.

As a next step, the payment processor communicates with the customer’s bank network to verify the payment details. Now, based on the bank’s response, the transaction will be either approved or declined.

If the transaction is approved, the payment is completed, and the funds are scheduled for settlement in the corresponding user’s account. This ensures a smooth and reliable transaction flow.

Different Types of Online Payment Gateway

Online payment gateways will vary based on how the transactions are handled and where the payment data is processed. Understanding these key types will help businesses choose a standard gateway that aligns with the operational needs, security requirements, and customer expectations.

Hosted Payment Gateway

The hosted payment gateway redirects customers from the business website to the payment service provider’s secure payment page to complete the transaction. Here, all the sensitive payment information has been collected and processed on the provider’s platform. This reduces the business’s exposure to cybersecurity risks and compliance responsibilities.

Best Suited For:

- Startup companies that are searching for a quick and hassle-free deployment.

- Small to mid-sized businesses.

- Businesses with limited PCI DSS compliance readiness.

Key Strengths:

- Faster implementation with minimal technical effort.

- Lower compliance and maintenance headaches.

- Robust security measures with proactive fraud prevention are overseen by the provider.

Self-Hosted Payment Gateway

Unlike the previous one, here customer enter their payment details directly on the business website. Here, the transaction data is securely transmitted to the gateway server for authorization and processing. With this unique approach, businesses can maintain greater control over the checkout design and user journey without the headache of managing the entire payment infrastructure.

Best Suited For:

- Growing businesses that are aiming to enhance their brand presence.

- Industries that seek a balance between control and security.

Key Strengths:

- Tailored checkout experience.

- Improvised brand consistency throughout the payment flow.

- A moderate control over data handling and processing.

API-Based Payment Gateway

API-based payment gateways integrate directly into the website or application. Without redirecting users, this enables payments to be processed entirely within the platform. This level of deep integration supports complex online payment gateway integration workflows, seamless user experiences, and advanced transaction management features.

Best Suited For:

- Businesses with custom products or subscription models.

- Enterprises and high-traffic platforms.

- Firms that rely on third-party integration services to connect their payment gateway with external platforms.

Key Strengths:

- Supports advanced features like saved cards and recurring payments.

- High scalability and flexibility for future growth.

- End-to-end control over the payment workflows.

Bank-Integrated Payment Gateway

Bank-integrated payment gateways link directly with the bank’s payment processing system. It allows transactions to be settled and authorized within the banking network. These specific gateways are often chosen for their reliability, regulatory alignment, and direct settlement capabilities.

Best Suited For:

- Regulated industries require strict financial oversight.

- Enterprises with high transaction volumes.

Key Strengths:

- Direct settlement with the banking institutions.

- Robust transaction stability and uptime.

- Enhanced compliance and regulatory confidence.

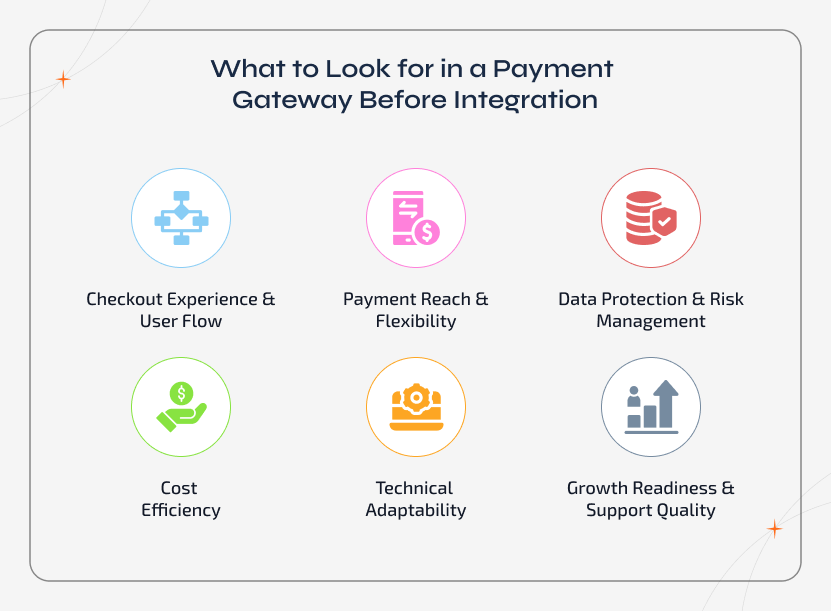

What to Look for in a Payment Gateway Before Integration

Predictive analytics relies on a certain range of analytical models to generate accurate forecasts and insights. Each model is specifically designed to address data patterns and decision needSelecting the best payment gateway is not just about making a technical decision. It’s more like a core thing that directly impacts the user trust, checkout experience, and revenue flow. By going through the aspects below, businesses can select a gateway that fits their current needs and future growths.

Checkout Experience & User Flow

A reliable payment gateway should support a smooth and distraction-free checkout process. Less redirections, quicker loading times, and transparent payment steps will minimize drop-offs and boost completion rates.

Payment Reach & Flexibility

The payment gateway should align with how your customers like to pay. Encourage diverse payment modes, currencies, and regional options, ensuring wider acceptance and better market reach.

Data Protection & Risk Management

Look for payment gateways that can actively manage fraud, encrypt sensitive information, and support secure authentication methods. A robust risk control prevents transaction failure and unauthorized access.

Cost Efficiency

Instead of focusing on transaction fees, do assess long-term cost efficiency. Key factors like refund management, chargeback handling, and operational overhead will affect the overall profitability.

Technical Adaptability

Flexible gateway allows quick integration with your online website’s architecture and other business systems. Clean customizations options, APIs, and future-ready features make the long-term maintenance much easier.

Growth Readiness & support Quality

The payment gateway must scale with increasing transaction volumes and evolving business models. The responsive technical support and a reliable performance are crucial during the peak usage and expansion phases.

How to Integrate a Payment Gateway Into a Website

Integrating a payment gateway into a specific website requires a structured approach. It must ensure secure transactions, a reliable user experience, and compliance with industry standards. Let's get on with it.

Step 1: Identify Business Requirements

Define your payment needs based on the target customers, supported payment methods, transaction volume, and compliance requirements. This helps in selecting a gateway that aligns with both technical and business goals.

Step 2: Select the Right Gateway Provider

Choose a payment gateway that supports flexible payment options that you’re expecting. Also, the one that you’re about to choose must offer strong security features and must integrate well with your website’s technology stack.

Step 3: Complete Verification

Further, register with the chosen payment gateway provider and complete the necessary verification process. This typically includes filling up the bank details, business documentation, and compliance approvals.

Step 4: Configure Payment Gateway

After this, from the provider’s dashboard, set up the payment preferences, currencies, settlement rules, and security configurations. This proves that the gateway is aligned with your regional and operational requirements.

Step 5: Integrate the Gateway

Integrate the payment gateway into your specific website. Use SDKs or APIs and follow the provider’s technical documentation to make sure accurate implementation and seamless checkout flow.

Step 6: Test in Sandbox Environment

Conduct rigorous testing using a sandbox or test credentials to ensure the payment flows, error handling, and transaction confirmations. This kind of testing helps to identify and eradicate issues before going live.

Step 7: Go Live & Monitor Performance

Once the testing is successful, switch to live mode and start processing real transactions. Continuously monitor the payment performance, transaction success rates, and security alerts to ensure long-term reliability.

Business Benefits of Integrating a Payment Gateway Into a Website

A well-integrated payment gateway delivers a wide range of benefits for businesses, which smoothens the checkout process and enhances the overall business credibility.

Scaling Business

An ecommerce website with payment gateway is built in a way to handle the increasing transaction volumes without any performance issues. If your business evolves, the system scales accordingly to support high traffic.

Real-Time Payment Tracking

Integrated gateways always provide real-time transaction status and reporting. This transparency helps businesses to track payments instantly and to maintain accurate financial records.

Improved Brand Credibility

A reliable payment experience reassures its users that the website is secure and trustworthy. This level of confidence strengthens the brand's credibility and boosts customers to repeat the purchase.

Payment Integration Best Practices for Maximum Efficiency

Implementing a payment gateway integration in website isn’t actually a straightforward process. The complexity lies in creating a seamless, trustworthy, and user-friendly experience. Businesses can follow the best practices mentioned below to make the integration even smoother and more effective.

Mobile-Friendly Checkout

Make sure that your payment forms and pages are completely responsive. This is because most of the users now proceed with online payment via mobile devices. So, a mobile-friendly checkout boosts conversions and minimizes drop-offs.

Less Form Fields

Make the integration in a way that asks only essential information. Long or complicated forms will frustrate users and enhance cart abandonment, so keep it simple and intuitive.

Multiple Payment Options

Offer various payment methods, including credit/debit cards, UPI, digital wallets, and net banking. Diverse choices means higher chances of successful payments.

Quick Loading Times

Optimize the payment pages for speed, because slow loading will frustrate users, especially for mobile networks, leading to transaction abandonment.

Guest Checkout Options

Not every user likes to create a separate account to initiate the payment. Allowing guest checkout will simplify the process and minimizes the barriers to completing the payment.

Transparent Charges

Display the taxes, service charges, or any other additional fees clearly. This is because hidden costs will always lead to cart abandonment and lower customer trust.

Common Payment Gateway Integration in Website Challenges Businesses Face

UPI Payment gateway integration in website can present various operational and technical challenges for startups and mid-sized businesses. Identifying these issues early will ensure a smooth implementation and reliable payment performance.

Transaction Errors & Payment Failures

Most of the time, businesses face failed payments, timeouts, or duplicate transaction errors. These kinds of errors frustrate users the most and will create a negative impression on the website and questioning the whole web app development process.

Integration Complexity

Integrating a payment gateway with already existing websites and applications can be technically challenging. This often happens when dealing with legacy systems and custom platforms, and leads to getting help from an e-commerce website project recovery team.

Compliance & Regulatory Requirements

Meeting with PCI DSS standards and regional financial regulations can be challenging and will consume more time. Non-compliance will lead to security risks, penalties, and restricted payment operations.

Limited Payment Method

Certain gateways don’t support all the preferred payment methods. This kind of limitation will reduce customer convenience and lead to increased cart abandonment, especially in regional markets.

Remedy: To overcome these technical challenges, businesses must pick up a reliable payment gateway provider those who have with robust technical support and scalable features. A well-planned integration, combined with rigorous testing and ongoing monitoring, helps in stable performance and a seamless payment experience.

When to Consider a Payment Gateway Integration Partner?

Businesses can think of working with a payment gateway integration partner when the requirements become more complex and start impacting the website's user experience. This usually occurs while handling multiple payment methods, scaling to new markets, and ensuring regulatory compliance. A reliable payment gateway integration service helps in streamlining the implementation while reducing the potential risks and possible delays.

Reaching out for experts also makes more sense when a business needs a future-ready payment setup that aligns with the evolving customer needs. With years of experience in secure and scalable integration, partnering with Sparkout and hiring web developers will help businesses implement payment gateways that work seamlessly with the digital platform while ensuring long-term reliability.